Elevator Pitch

Innovative Solutions and Support Inc (NASDAQ: ISSC), or IS&S for short, operates as a manufacturer of avionics systems and components for aerospace applications. While they are recognized in the industry for being a smaller player with a more niche focus, they have operated for 30+ years under the hands of a renowned founder known for being an avionics industry veteran and innovator that held a significant ownership stake in the business. The founder recently passed away in 2021, leaving IS&S to appoint new management, who have taken on a new strategy of pursuing complementary acquisitions where they see fit. My theses around the stock cover 3 main points:

IS&S recently acquired certain product lines from Honeywell, that was not only purchased for a bargain multiple, but is also expected to capture operating leverage from unused capacity within the company’s existing facilities that should boost margins and earnings over the next few years with little incremental capex required.

My research into alt data also indicates that IS&S should benefit from heightened sales of autothrottles over the next few years given recent orders and strong demand for King Air aircrafts manufactured by Textron (which the company’s autothrottles are standard equipment on). Similarly, I also expect the company’s UMS product to benefit from structural industry challenges currently impacting global aviation, particularly the pilot shortage.

Notwithstanding the seemingly positive changes that have taken place over the past year, the stock currently trades near its 52-week low and at a trough multiple, I believe this is for indiscriminatory reasons as the former-CEO / founder’s trust has sold ~2.5M shares (~25% of free float) since March of last year following his passing. This consideration, together with the fact that the stock is largely under-the-radar (no coverage, <$100M market cap), leaves me to believe that the stock is heavily mispriced.

I value IS&S based on my projection of $0.49 in EPS in 2026, which together with a 20.0x multiple, implies a ~$10 share price and ~85% upside; based on my bear case assumptions, the risk / reward profile also skews asymmetrically at 6.8x.

The Business

Founded in 1988, IS&S operates as a systems integrator and manufacturer in the avionics industry. The company designs, manufactures, and sells avionics equipment which are sold to both OEMs for new aircrafts as well as for retrofit applications. Avionics is a broad term used to refer to electronic systems used on aircrafts, while there are hundreds of these systems used on a plane, IS&S sells systems primarily pertaining to cockpits for both commercial and military applications. As one might expect, the systems themselves are quite technical to understand, but for readers that are interested, I’ve tried to explain (at a very high level) the functions and practicality of each product included in the company’s product brochure below.

Air Data Display Units: Computes, processes, and displays crucial flight information including altitude, target altitude, barometric setting information, height and altitude alerts, airspeed, and alert flight control data.

Altimeter: Instrument used to measure the altitude of an aircraft above a certain levels (usually sea level), works by reading atmospheric pressure outside the aircraft and converting it into an altitude reading.

Airspeed Indicator: Displays indicated air speed, ground speed, true speed, and other measures related to speed.

Digital Air Data Computers: Computes air data and supports operation of altimeters, mach airspeed indicators, autopilot controllers, and other equipment.

Engine / Fuel Instruments: Includes a shaft horsepower indicator, a turbine inlet temperature indicator (replacement for earlier P-3 TIT Indicator made by Lockheed), and a fuel quantity indicator / totalizer (instrument that measures how much fluid has passed through a sensor over time).

Primary Flight / Navigation Displays: Screens that display air data including engine and fuel data, altitude, heading and navigational data, maintenance and aircraft health data, and alternative source information. IS&S heavily focuses on it’s Flat Panel Display Systems (“FPDS”) product line, which are active matrix liquid crystal display (AMLCDs) screens (the same ones used in high-resolution TVs, computers, smartphones). These screens replace conventional analog and digital displays and adds on additional information that are not often displayed in them. IS&S mentions that older aircrafts that upgrade to this see extended operational lives. These screens are also used for security monitoring and as tactical workstations on military aircraft.

Mission Displays: Specialized displays that provides information tailored to operational needs, IS&S supplies 2 kinds—Boeing KC-767 aerial refueling operators, and for US Navy landing craft air cushion programs.

Multifunction Displays: Display systems designed to consolidate pieces of flight information, IS&S provides this to the KC-767 alongside mission displays.

Engine Displays: Engine display screens that are designed to replace engine instrument clusters.

Autothrottle Systems: Device that controls the trust / power of an aircraft engine. IS&S sells its TrustSense Autothrottle which serves as a holistic autothrottle solution that serves both takeoff and landing phases, while also incorporating engine and speed exceedance protection. This equipment has become standard in Textron’s King Air 260s and 360s, with management continuing to pursue additional platforms in the military and regional airline markets.

Utilities Management System (“UMS”): System used to monitor and control various utility functions in an aircraft—IS&S states that this monitors aircraft sensors, controls aircraft systems, and is scalable to meet the requirements of any aircraft. The UMS replaces 22 traditional subsystems in an aircraft and reduces the need for multiple interface, distribution boxes, support equipment, and wiring—it essentially consolidates aircraft sensors.

Global Positioning System Sensor Unit: GPS satellite receiver.

Integrated Standby Unit: IS&S states that this calculates, processes and displays altitude, attitude, airspeed, slip/skid, and navigation display information in a logical and concise single instrument display.

IS&S categorizes their sales into 3 segments:

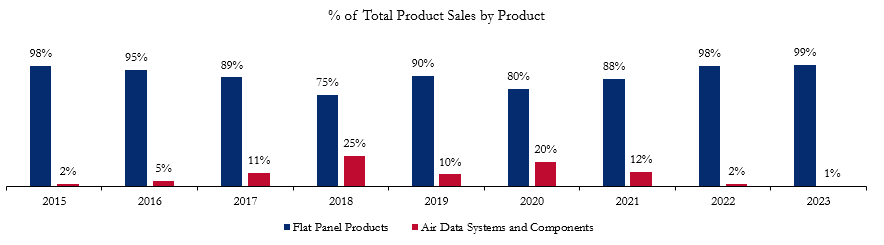

Product, which includes the sale of equipment to customers including various OEMs, commercial air transport carriers, aviation companies, the DoD and related government agencies. The company states that flat panel products have historically comprised most of the product sales, but to avoid confusion, its worth clarifying that flat panel products do not only include FPDS-es—an inquiry I sent over to management confirmed that it also included autothrottle and other systems.

Customer Service, which involves services IS&S provides its customers using either field service engineers or its in-house repair and upgrade facility

And lastly, Engineering Development Contracts, which are revenues earned from additional development costs when customers order FPDS-es customized to meet particular requirements.

The revenue split and gross margin profile of each segment can also be found below:

IS&S lists out all of their clients on their website, but the 3 largest clients that they currently have are Pilatus, ATSG, and Textron (chart below outlines their respective contributions to total revenue over the years). Most of their clients are blue chip companies alongside major aviation players (think Boeing, Lockheed, American Airlines, etc.) The company also sells heavily to the government contractors and agencies, particularly the DoD, these entities comprised 9%, 14%, and 18% of product sales in 2023, 2022, and 2021 respectively.

IS&S primarily serves customers in retrofit markets—although I wasn’t able to find anything within their disclosures that breaks this down, an EFHutton initiation report estimated their 2022 sales mix to being 40% OEM, 40% aftermarket, and 20% repair & service; they also estimate 2022 sales being split by 44% related to business jets, 45% cargo transportation, and 11% military and government. International sales have also comprised ~40% of total sales over the past 3 years, with the remainder being from the US.

The company currently has 4 OEM production contracts in place with management aiming to secure more as they gear towards earning revenues that are more recurring in nature. The 4 OEM production contracts consist of the following:

Boeing T-7A Red Hawk Trainer Program: The most recent contract that IS&S has been awarded, began in July 2023. Provides GPS sensor units to the Boeing T-7A Red Hawk trainer (aircraft designed to facilitate pilot training).

Boeing KC-46A Tanker Program: Contract awarded in June 2011 for IS&S to provide Aerial Refueling Operator Control and Display Units to the KC-46A tanker (military refueling and strategic military transport aircraft). The USAF (US Air Force) awarded Boeing with a contract to replace aging KC-135 tankers with KC-46As, with the intent of procuring 179 by 2027. As it currently stands, the last of the KC-46As are expected to be delivered to the USAF by 2029.

Pilatus PC-24: IS&S provides its utilities management system (“UMS”) for the Pilatus PC-24. Multi-year production contract began in 2013 with IS&S’s UMS becoming standard equipment on every production PC-24.

Textron King Air 260 and 360: Multi-year agreement with Textron to supply IS&S’s ThrustSense Autothruttle on King Air 360s and 260s. Became standard equipment on the 360 in 2020, and on the 260 in 2021.

History:

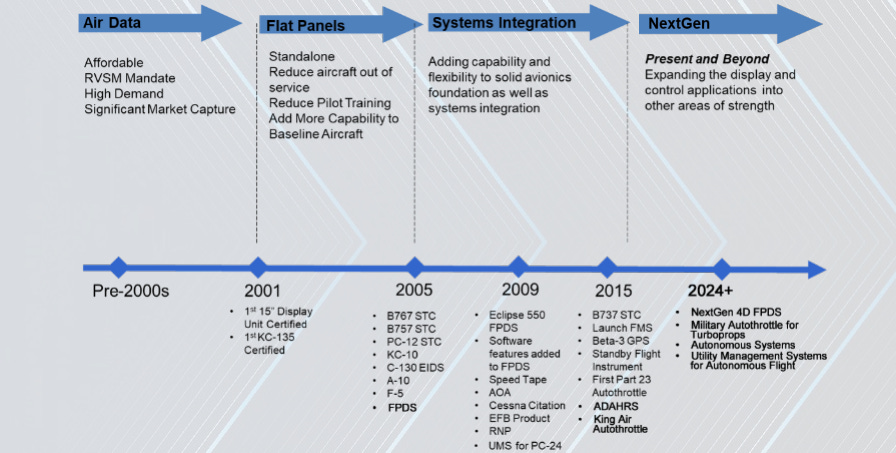

The company, for the most part of its history, has been operated under the hands of Geoffrey S. M. Hendrick, who founded the company in 1988 and served as both the Chairman and CEO up until his passing in January 2022. Geoffrey was recognized as major figure in the avionics industry having held ~100 patents and coming from a line of aviation entrepreneurs. The company went public in 2000, and had a few years where they exhibited heightened revenue growth over increased RVSM requirements being phased in, whereby they profited from the sale of air data equipment. RVSM requirements—which are essentially rules surrounding airplane vertical separation that are meant to ensure safety—started phasing into international North Atlantic routes beginning in 1997, and then into Pacific and European air routes later in 2002. Geoffrey spent time in the 90s developing patents for advanced altimeters, building ones that were 20x more accurate than altimeters at the time, which allowed IS&S to be well positioned for when RVSM requirements began phasing in. IS&S developed numerous RVSM-certified solutions for both commercial and business jets, which led to them reaching a peak revenue of ~$63M in 2006. Following this, the company turned its attention to flat panel display products, with Hendrick leading the company to focus on retrofitting older aircrafts with newer displays. With Hendrick passing away in 2022, Shahram Askarpour was named the new CEO. Askarpour was previously President of Engineering at IS&S, and joined in 2003 as the VP of the department. IS&S continues to operate as a niche player in the avionics industry, primarily being known for their flat panel retrofit solutions and focus on cockpit avionics.

(Company Investor Presentation – May 2024)

Given that IS&S doesn’t occupy a significant % of the avionics market, and moreso operates as a niche player, I don’t think its worthwhile going too in depth into what the industry landscape looks like. Other competitors are much larger (Honeywell, Garmin, Collins, L3, etc.) and provide more comprehensive solutions in comparison to IS&S’s specialized focus. It’s for this reason as to why I believe the company has been able to achieve high gross margins averaging ~50% over the past 10 years. Many of their products are mission critical in nature with few competitors given their niche focus. With that being said, my theses around the stock primarily concern recent strategic changes, near-term catalysts, and a removal of an overhang, as opposed to the quality of the business.

Thesis I: Management’s Strategy of Monetizing Idle Capacity Through Bolt-On Acquisitions

Following the passing of IS&S’s former-CEO and Founder—Geoffrey Hendrick—in 2021, the new management of IS&S set in place a new strategy geared towards driving growth in-organically through acquisitions.

Prior to this, total revenues had exhibited a strong organic growth CAGR of ~10% since 2017, but the rationale behind such a strategy was not only to increase sales, but also to make use of underutilized infrastructure—particularly their sole manufacturing and design facility—which sat at a ~30% utilization rate, in other words, they could triple sales using their current production infrastructure with little capex needed.

This later led to IS&S’s acquisition of product lines from Honeywell Aerospace. Below are a series of transcript excerpts that illustrate where this strategy came from and how it developed:

To give a rundown of the acquisition, IS&S essentially entered into an asset purchase agreement with Honeywell to purchase the product lines and related license rights for select inertial, communication, and navigation products. IS&S ended up paying $39.5M in cash consideration for this (took on $20M in debt via a term loan to finance it) and only recognized $4.6M in goodwill in the purchase price allocation, with the remainder being allocated to intangibles (license agreements and customer relationships at ~$16.4M), inventory (~$12.1M), and equipment / assets in construction (~$3.8M). The low amount of goodwill recognized, along with the fact that IS&S paid a mere 3.75x multiple on 2022 operating income for this acquisition made sense once I discovered that this purchase was not done for financial reasons on Honeywell’s end, but moreso for succession purposes, which was confirmed by management in their Q3’23 earnings:

Its hard to argue that IS&S did not secure a great deal on this acquisition, as not only did they acquire this business for incredibly cheap, but the products that they acquired were noted to fit well with their current product portfolio, while also retaining attractive margin profiles. From a slide in one of their presentations, they highlighted 8 different products that they acquired:

(Company Investor Presentation – May 2024)

Management projects that with this acquisition, they expect 2024 revenues to grow over 40%, EBITDA to grow by 75%, and the acquisition being EPS accretive. I estimate 2024 EPS as being ~$0.43 / share under base case assumptions, representing a ~35% increase from 2023.

Additionally, debt should be completely paid down by FY25 given that capex requirements are very limited.

Despite this deal being overwhelmingly favourable for IS&S, the share price remained largely flat on announcement and a few months after—I’ll explore why I think the reason for this is soon.

Nonetheless, management remains keen on continuing to execute on complementary acquisitions where they see fit. Considering the fixed assets that IS&S currently has in place, continuing this strategy should create value through capturing operating leverage to expand margins. This is a shift in direction from the legacy IS&S which I believe will be favourable to shareholders.

Thesis II: Alt-Data Suggests Strong Autothrottle Sales Ahead / UMS Product Addresses Structural Industry Headwinds

The crux of this thesis revolves around increased sales of autothrottles over the next 3 years.

As previously mentioned, one of IS&S largest customers is Textron. IS&S supplies its ThrustSense autothrottles for Textron’s King Air 360 and 260 aircrafts, this product has also become standard equipment on both aircrafts. While I won’t go too in depth, I think its worth providing a high-level overview of these aircrafts. The King Airs are a family of turboprop aircrafts manufactured by Textron under their Beechcraft brand. They serve a versatile range of purposes spanning from business, medical, cargo, private air travel, government, pilot training, and for landing into remote areas with short runways—these are very popular utility aircrafts and you’ve likely seen them in movies like Jurassic Park. Textron divides their King Airs into families, with the model 90 and 100 series being older than their 200 and 300 counterparts. The 200 and 300 series have been in production since 1974, with both the King Air 360 and 260 being the latest generation having recently been introduced in 2020; in total, Textron has delivered 7,600+ King Airs since 1964, and has recently delivered their 100th King Air 360.

Textron’s turboprop business recently secured contracts back in the first 3 quarters last year that should result in heightened deliveries for both King Air 260s and 360s up until 2026, IS&S stands to benefit from increased revenue coming from their autothrottle business, with operating leverage and minimal R&D spend heavily contributing to margins:

The first contract that Textron announced was back in Q1 2023 with the U.S. Navy, where they were awarded with a contract to develop and supply them with T-54A multi-engine training system aircrafts (the King Air 260), these planes were chosen to replace the previous T-44C navy trainer aircrafts. The base contract is for 10 King Air 260s (valued at ~$113M), with an option for the additional procurement of a total of 64 aircrafts (total contract value at ~$677M). The second order was announced in Q2 and Q3 of their earnings, where Textron stated that they received an additional order for 11 and 17 special mission King Air 360s respectively in the two periods. Both the contract and orders are expected to be fulfilled from 2024 through 2026.

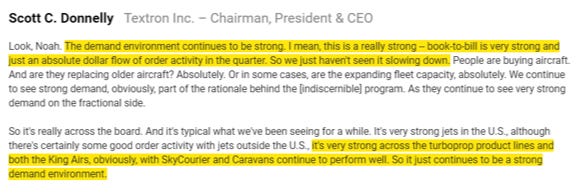

Assuming deliveries are spread equally through the 3 year period (and also assuming the procurement of all 64 aircrafts), the two contracts represent a ~73% and ~26% uplift to the average number of annual deliveries Textron has made for King Air 360s and 260s. I also believe that it is likely that Textron should continue to sell an increased amount of King Airs based purely off the fact that the 260s and 360s are a newer model that have just begun being ushered in, combined with the fact that some of Textron’s commercial manufacturing facilities were left temporarily closed during a few quarters of the pandemic as a result of reduced demand. Additionally, Textron themselves cite strong demand across turboprop products:

Textron Q3’23 Earnings:

Textron Q2’23 Earnings:

To figure out how much IS&S could potentially earn from the sale of delivery of King Airs up until 2026, I back solved into my estimate of average revenue per aircraft figure—note that most if not all of this revenue from Textron is from the sale of autothrottles (confirmed through my inquiry with management). From online articles and listings, I found that IS&S’s ThrustSense is priced at around $80,000 per aircraft for retrofit, EFHutton mentioned in their April 2023 initiation report (coverage now discontinued) that they estimate the cost to be around $90,000. Given that retrofits are typically more expensive than OEM contracts, I take a much more conservative approach and use a $45,000 as my “revenue per aircraft” figure that IS&S is able to monetize from each Textron King Air delivered, this is also in line with the number you arrive at if you take the revenue IS&S earned from Textron from 2021 to 2023, and divide by the total number of King Airs delivered in each of the respective years.

Now assuming my standalone base case gross margin assumption of 57.5% on product revenue, IS&S should be able to see an incremental >$1.5M (FY23 stands at ~$7.4M) flow into operating income each year over the next 3 years even if the U.S. Navy does not procure more 260s from the current base contract of 10.

Despite this seemingly significant tailwind, little to no market participants are paying attention to this and instead are focusing on acquisition integration. Increased delivery of King Airs, alongside IS&S’s recent acquisition should both result in increased earnings over the next 3 years.

Additionally, a smaller part of this product thesis is that IS&S’s UMS Solution addresses structural aviation industry headwinds

I suspect that alongside increased sales of autothrottles, organic sales of UMS should also grow. The aviation industry is currently facing one of the largest pilot shortages in history, with many factors exasperating this issue. During COVID-19, demand for air travel plummeted leaving many airlines desperate to preserve cash, despite even receiving federal aid. In an effort to do so, airlines offered employees early retirement package and buyout packages, which many employees decided to take. As an example, Delta stated that they were taking steps to becoming a more nimble airline to help navigate through the pandemic, and through early retirement / buyout packages, 20% of the company left over that week. This factor, combined with the fact that the pipeline for new pilots entering the industry has gotten tighter, led to a worsening pilot shortage once demand rebounded following the pandemic. Flight school closures and reduced capacity, baby boomers reaching the FAA-mandated retirement age of 65, and a reduced number of pilots leaving the military further contribute to this issue. With demand for pilots not expected to shrink anytime soon and 30,000+ pilots on the cusp of retiring, the pilot shortage is expected to continue past 2030 with a shortage of ~24,000 pilots estimated in 2026.

IS&S’s UMS system, which became FAA-certified in 2018 and is installed on Pilatus PC-24 aircrafts is expected to be a beneficiary of the pilot shortage given that it works to alleviate workload for pilots while also reducing power and resource consumption on an aircraft. To reiterate the value proposition of the UMS product, it essentially works by controlling 22 traditional control boxes on an aircraft, including navigation, auto-flight, landing gear, electric loads, oxygen systems, and cabin pressurization. Additionally, the UMS allows for a ground-based pilot to work alongside flight crew in the event of an emergency.

While UMSes don’t provide a direct replacement for a pilot, they certainly can reduce the need for having 2 pilots, especially on turboprop planes. For context, turboprops can already be flown with either 2 pilots or 1, the former is usually for larger turboprops for short-haul and regional flights, while the latter are typically smaller with simpler systems. From what I was able to find, FAA regulations around single pilot flight on turboprops usually center themselves around maximum gross weight requirements, with single pilot flight not being allowed on large airplanes (gross weight above 12,500lbs), however, some exceptions exist with many aircrafts over the weight requirement being certified for single flight operations—an example being the Pilatus PC-24 (18,300 lbs).

Given that the planes that IS&S provides UMSes to are already suited for single pilot travel from a regulatory standpoint, I suspect that this product will continue to be sold and installed on turboprops amidst the pilot shortage. Calls with an industry participant confirm this—when asked about whether or not they see a case where a UMS replaces the traditional two pilot cockpit model entirely, an industry participant noted how there is a small case scenario where smaller aircrafts, particularly smaller jets and turboprops can reap the advantages, despite implementation on the airliner range of aircrafts being far away. IS&S mentions that they continue to see stable revenue from their OEM contract with Pilatus for UMSes, additionally, management mentioned that in Q1’24, the R&D that they spent was related to a contract that they had with Pilatus to generate a 2nd generation of UMS products, which they expect to be installed into additionally airframes, with the potential of being extended into adjacent markets. UMS adoption should be furthered by this structural industry headwind over the next few years, to which IS&S will be a beneficiary.

Thesis III: Removal of Overhang Following Complete Liquidation of Former-CEO’s Estate

Up until Geoffrey S. M. Hendrick’s passing, he owned around ~3.5M shares or ~20% of shares outstanding. Since then, his estate has sold out much of his ownership in the company with sales beginning in March of last year, and now owns only ~1M shares or ~6%. I’ve outlined all of the transactions below which you can also find in my attached spreadsheet.

I believe this indiscriminate selling has caused the stock price to not reflect many of the positive changes that took place over the past few months. Keep in mind that IS&S is a ~$100M market cap niche business with no major institution covering the stock after Wolfe discontinued coverage back in October 2023, so I suspect that not many market participants paid attention to this. These two factors, the first being indiscriminate selling, and the second being that the stock is largely under-the-radar, has caused what I believe to be a mispricing in the stock. IS&S currently trades at a 5-year trough multiple of ~10.6x LTM EBIT and ~14.8x LTM earnings in comparison to where it has historically traded at around ~25x EBIT and 30x earnings, which is also where aircraft component peers trade. To me, this sell-off provides an entry valuation to buy IS&S, I expect the estate to be completely liquidated by the end of the year.

Valuation:

Under base case assumptions, I model IS&S achieving $0.49 in EPS by 2025 at which point the stock should trade at around ~20x, implying ~85% upside and a ~23% IRR up until 2026—this also assumes no credit given to further acquisitions down the line. Moreover, my bear case assumptions show limited downside from current share price levels, implying an asymmetric 6.8x risk / reward profile. My full model is attached below for reference.

Risk / Catalysts:

Catalysts:

Next 6 - 12 Months: Removal of overhang following Estate of Geoffrey S. M. Hendrick’s complete exit from the stock.

Next 6 - 12 Months: Margin enhancement through IS&S capturing operating leverage following complete acquisition integration.

2025 - 2026: Increased sale of ThrustSense autothrottles in light of heightened deliveries of King Airs.

Risks:

Poor acquisitions made by management

Demand and orders for King Airs fall

Disclaimer:

This article is intended for informational and educational purposes only and should not be construed as financial or investment advice.

This was a nice write up. I have a small position here; do you think the Honeywell acquisition has been a good one? Revenue appears to tracking mgr's call a year ago announcing the acquisition, but not sure about EPS